Weaker Canadian Economy = Lower Rates?

How low can interest rates go in Canada?

Possibly much lower.

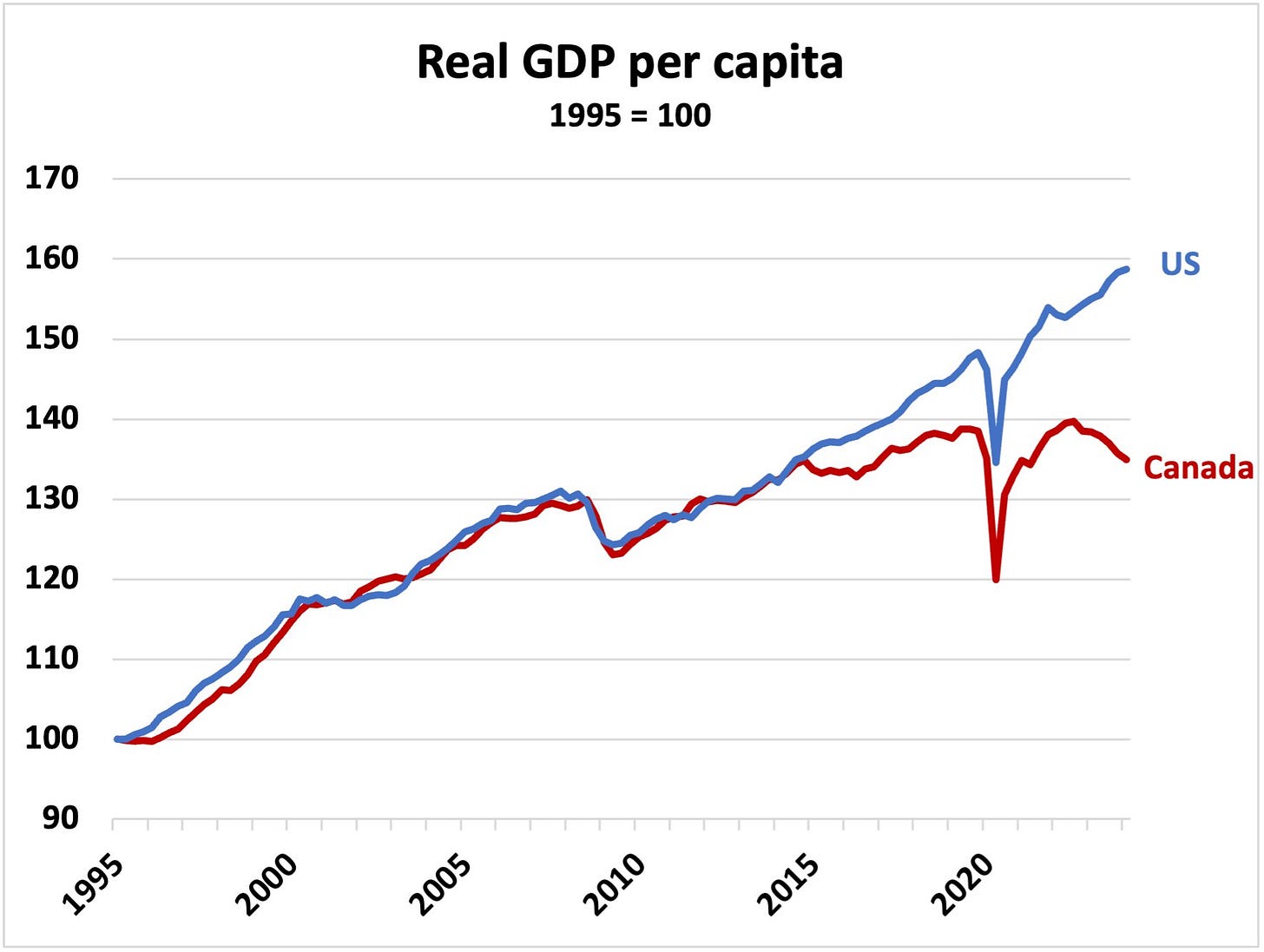

Canada is falling behind the United States, especially in terms of GDP per capita—a key measure of economic health—and experts believe the gap is only going to widen.

Canada continues to underperform relative to the US - especially on a GDP per capita basis. And experts believe this problem is going to get worse.

What is GDP Per Capita?

GDP per capita is a simple way to measure how much economic value a country produces per person. Here's how it breaks down:

GDP (Gross Domestic Product): The total value of all goods and services a country produces in a year.

Per Capita: Dividing GDP by the population to calculate the average output per person.

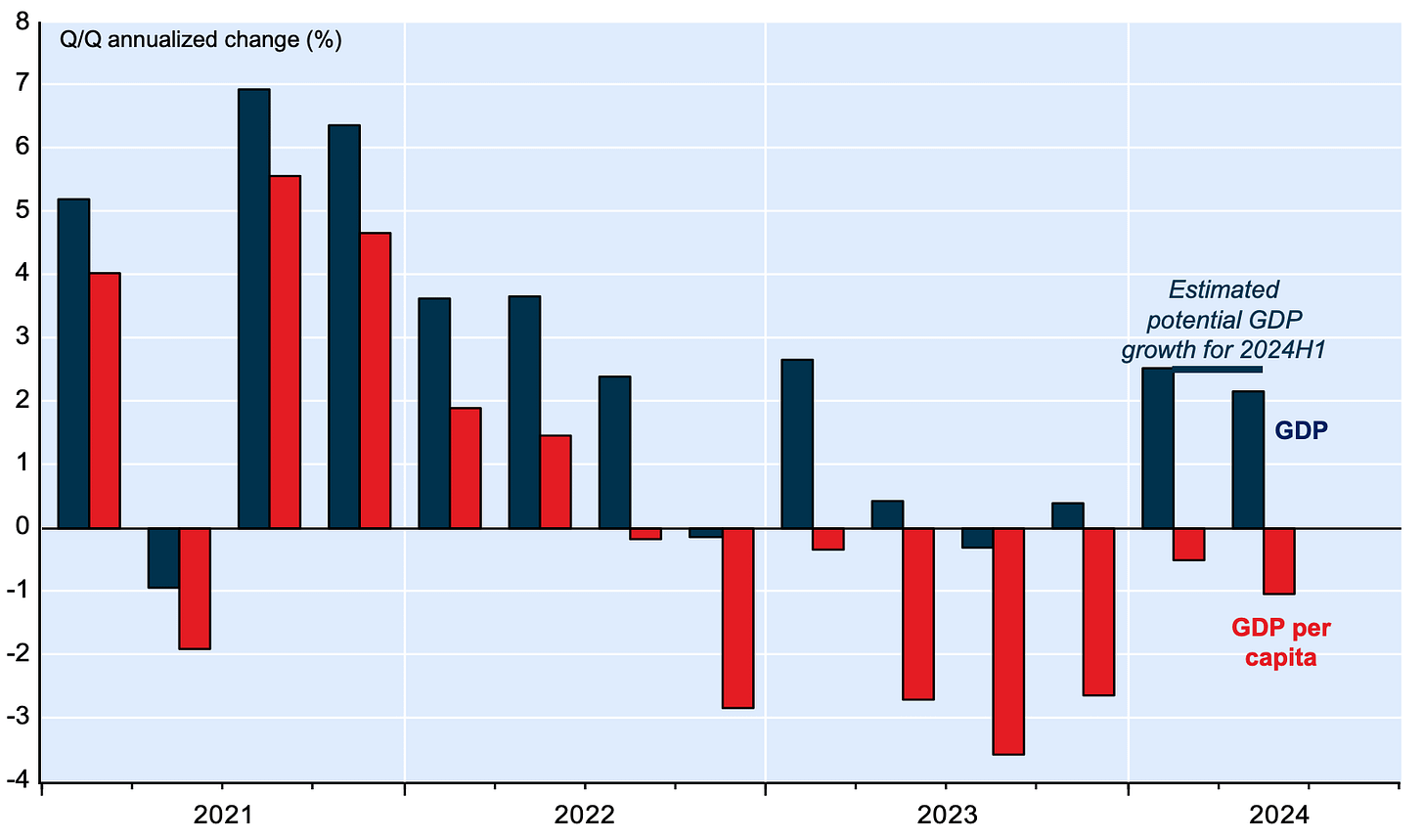

Although Canada’s overall GDP is growing, much of that growth is driven by population increases that boost overall consumption, production, and tax contributions. On a per-person basis, Canadians are getting poorer.

Canada’s Increasing GDP

While Canada’s overall GDP is growing, much of that increase is driven by our rapidly growing population.

As more people consume goods and services, more is produced and more taxes are collected for public spending. However, on a per-person basis, we’re actually becoming poorer.

Canada’s GDP per capita has been consistently lagging behind the U.S., which has shown steady growth. In fact, Canada’s GDP per capita has been negative in 7 out of the past 8 quarters.

Canada’s Widening Gap with the U.S.

In 2023, the U.S. real GDP per capita was 43% higher than Canada’s.

By the end of 2024, this gap is expected to reach nearly 50%.

What’s driving this divergence?

U.S. Policies:

Trump’s corporate tax cuts and tariffs on imports stimulate U.S. economic growth and inflation.

These policies, however, hurt Canada indirectly by reducing our trade competitiveness.

Canada’s Domestic Challenges:

Lower immigration targets slow population growth, reduce GDP potential, accelerate aging demographics, and strain public services like healthcare.

Business investment is declining, limiting productivity gains that could offset slower population growth.

Total GDP Formula: Population x GDP Per Capita

If Canada’s population decreases, as projected over the next two years, and we don’t see a boost in productivity (which many economists aren’t expecting, given the decline in business investments), our total GDP will shrink.

To counter this, Canada may need to lower interest rates further to encourage productivity and business investment.

Meanwhile, the U.S. Federal Reserve is maintaining higher interest rates, further increasing the future interest rate gap between the two countries.

Implications for Mortgage Holders and the Canadian Dollar

Lowering rates would:

Provide relief for mortgage holders and encourage consumer spending

Likely weaken the Canadian dollar relative to the U.S. dollar, which has already been under pressure.

Encourage business investment and productivity

This would bode well for mortgage holders, but in turn destroy the Canadian dollar relative to US - which we are already seeing is taking a massive hit.

Household Debt and Consumption

Canada faces additional challenges with rising interest rates:

Mortgage renewals at higher rates will weigh on household budgets, reducing disposable income.

Lower household consumption will result in less demand for goods and services, leading to fewer jobs and slower GDP growth.

To keep GDP positive, further rate cuts may be necessary.

Future Outlook for Interest Rates and Housing

The Bank of Canada has signaled its willingness to lower rates independently of U.S. policy, citing Canada’s “flexible currency.”

RBC projects the overnight rate could drop to 2% by summer 2025, potentially bringing variable mortgage rates back to the low-to-mid 3% range.

For the housing market, lower borrowing costs could:

Stimulate demand, especially with pent-up buyer interest.

Offset challenges like rising rates on renewals, creating a busier real estate market in 2025.

If you enjoyed this newsletter, please consider leaving a 5-star review below

If you have any financing questions or need any financing assistance - book a call in the link below:

Disclaimer: This is not financial advice. The information shared here is for educational purposes only and should not be considered as financial or investment advice. Always consult with a certified financial professional before making any financial decisions.